If you’re reading this, you are likely among the generation born between 1981 and 1996, and you’re probably contemplating homeownership. It’s a significant milestone that can feel like a distant dream at times. But don’t worry, because in this blog post, we will explore the world of mortgages and how you, as a millennial, can turn that dream of owning your own home into a reality in the digital age.

Understanding the Millennial Real Estate Journey

Before we dive into the nitty-gritty of mortgages, let’s talk about the unique factors and challenges that define you, the millennial homebuyer:

- **Financial Hurdles:** Many have launched careers during a very challenging period in time. This has impacted your ability to invest or save for a down payment. What about those student loan repayments that are starting back up? The deferment phase of these loans has lapsed further reducing the ability to follow through with becoming an homeowner.

- **Tech-Savvy Nature:** You are the generation that grew up with technology at your fingertips, and are comfortable with online research. This can be a huge advantage when it comes to shopping for a mortgage.

- **Flexibility in Lifestyle:** Many of you value flexibility in your life choices and that includes where and how to live. Some prefer the hustle and bustle of urban living, while others seek the peace of the suburbs or the tranquility of rural areas.

- **Environmental Consciousness:** A good number of you are environmentally conscious and may prioritize energy-efficient or eco-friendly homes.

- **Life Milestones on Your Own Terms:** Compared to previous generations, you tend to delay traditional life milestones like marriage and parenthood, which can have a significant impact on your housing decisions.

How to Prepare for a Mortgage

Now that you know the journey, let’s get into the specifics of mortgages and how you can navigate the homebuying process effectively:

1. **Financial Readiness:**

– Pay Down Your Debts: Before you even think about a mortgage, focus on paying off high-interest debts, like credit card balances and student loans.

– Save for a Down Payment: While there are programs that allow for smaller down payments, having a substantial one can lower your monthly mortgage payments and increase your chances of approval. Please note that you don’t need 20% to put down on a home. A down payment as simple as 3%-5% (depending on the loan selected) is more than sufficient to acquire a home.

2. **Mortgage Options:**

– Conventional Loans: These types of loans are offered at a fixed-rate or an adjustable-rate. Consider whether you want a fixed-rate mortgage, which offers predictable monthly payments, or an adjustable-rate mortgage, which might start with lower payments but can change over time.

– FHA Loans: Federal Housing Administration (FHA) loans often require smaller down payments (3.5%) and have more flexible credit requirements, making them a popular choice for first-time buyers.

– VA Loans: If you’re a veteran or active-duty service member, VA loans offer favorable terms and may not require a down payment; however, you may be subject to a funding fee. But don’t worry, that can be rolled into the loan if desired..

3. **Online Tools and Resources:**

– Take advantage of online mortgage calculators and tools to estimate your monthly payments, explore different loan options, and compare interest rates from various lenders.

– Consulting with a mortgage advisor (like me!) is a great resource that often doesn’t cost anything and we are able to answer questions about the process, address market concerns, and provide advice regarding good debt (the type of debt that works for you instead of against you).

– Use mobile apps and websites to search for homes, connect with real estate agents, and stay updated on the latest listings.

4. **Credit Score and Credit History:**

– Maintain healthy credit habits to boost your credit score. This is a crucial factor in mortgage approval and interest rates.

– Any revolving credit such as credit cards should have balances maintained below the 30% available credit mark. This is where creditors see that you are the most responsible as you are using credit instead of depending on it.

5. **Pre-Approval:**

– Get pre-approved for a mortgage before you start house hunting. It shows sellers that you’re a serious buyer and helps you make competitive offers.

– This task can be simply achieved by speaking to a mortgage advisor (like guess who?). By providing some basic financial and employment information they can determine your maximum purchasing power.

6. **Millennial-Friendly Lenders:**

– Speaking of mortgage advisors, there are many who recognize the challenges your generation faces. Many of which offer digital mortgage application processes, 24/7 customer support, and educational resources tailored to your needs.

7. **Homebuying Process:**

– Collaborate with a real estate agent who understands your preferences and financial situation.

– Consider factors like the neighborhood’s proximity to work, schools, and amenities.

– Don’t rush your decision-making process; take your time to find the right home that fits your lifestyle.

And finally…

As we can see, the path to homeownership might have its challenges, but there are also unique strengths and resources at your disposal.

With careful financial planning, thorough research, and the right mortgage advisor, you can make that dream of owning your own home in the digital age a reality.

Your generation continues to shape the housing market, so embrace technology and information to make informed decisions about mortgages and home buying.

The future of building generational wealth through homeownership for your generation is bright, and with determination, it’s well within your reach.

Ready to embark on your homeownership journey with confidence? Discover the innovative mortgage solution that’s changing the game. The “2-1 Buydown” mortgage offers you the power to control your finances and make your dream home a reality sooner than you think.

What’s the Secret?

With the 2-1 Buydown, you’ll enjoy the flexibility of lower initial interest rates, making your early mortgage payments more affordable. It’s like getting a head start on your homeownership adventure, allowing you to settle comfortably into your new abode.

Stay tuned for more Real Estate and Mortgage tips!

Blog provided by:

Sean Whitten

Trusted Mortgage Advisor

Integrity Mortgage

DRE: 02196327

NMLS: 2435128

We appreciate your referrals!

Need help with Social Media, Internet Marketing, Web Design? Send me a message@ vickie@wellmanworks.com.

Have a great week!!!

Alignable – Thanks for Voting!

- Alignable has been around since 2014, is US-based and has over 7 million users in more than 35,000 communities. (2020 they had 4.5 million)

Alignable is a Boston based company that aims to connect the world’s local businesses and organizations. It’s made up of a partnership between various companies and provides business owners with a technology that helps users effectively network within the local community. Their services aim at improving business owners’ search for customers.

The connection created allows business owners to connect among themselves and share resources such as business advice, recommendations, and services. By doing this, the business economy is greatly enhanced.

Connected Communities

The large network formed connects various businesses in local communities. Through the community, the business owners can message one another about important updates and share events, promotions, and job openings, etc.

Trusted Networks

The networks are formed by trusted business owners. From various locations and different industries, you get targeted customers depending on what you are looking for.

Customers obtained through the network are from people that you can trust.

Business Owner Forum

Under the business owner forum, there are multiple answers to questions that you might have. There is a Q&A with Frequently Asked Questions as well as a business owner discussion forum.

The business owner discussions enable you to ask for and receive advice related to your line of work. You will receive suggestions from industry peers and the best solutions for any challenges you might be facing.

- Alignable is free, and there are premium features. The free account consists of a connection radius of 2 Miles (reaching as many as 500 businesses), 10 monthly Connections, and an Optimized Profile Page. With the paid versions, you get more Connections and a larger reach.

Is Alignable right for you?

Want Educational Updates About Internet Visibility?

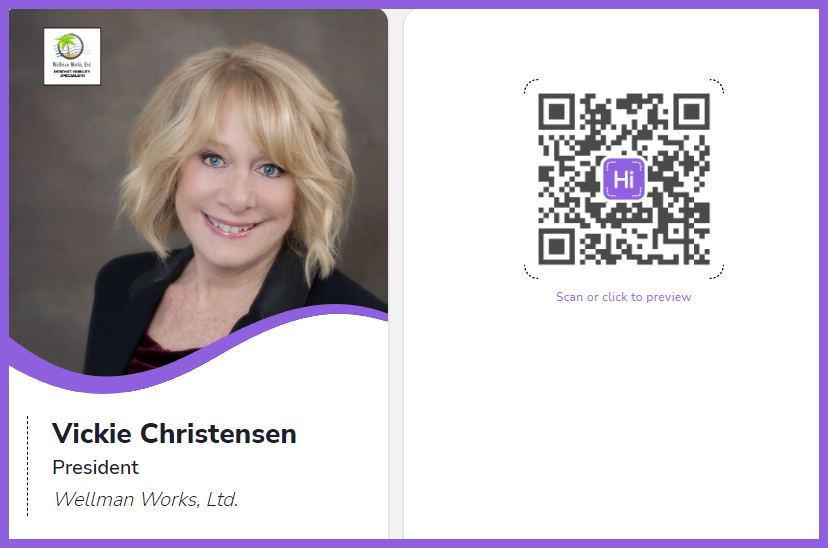

Vickie Christensen of Wellman Works Ltd. in Cameron Park, specializes in getting your business found on the Internet. I use my wealth of knowledge in the technical and marketing field earned over the last 30 plus years. I love working with businesses and making them more successful because that makes our community stronger.

Years of digging in and looking for the solutions that big companies can afford brought me, as a small business here. What I’ve spent years studying and applying to my own businesses are available to you.

Internet Visibility and Brand – you have found the person that listens and understands and will help you understand. It is my mission to give the opportunity that large companies have to your business and to promote the ethics of the Rotary 4-Way Test: In all things we do and say; Is it the Truth, Is it fair to all concerned, Will it build good will and better friendships, and Will it be beneficial to all concerned.

I look forward to hearing from you and discovering how I can best help you.

For digital business card https://bit.ly/VickieBusinessCard

Please call or text me at 916-835-5704 or make a quick call appt. at https://meetwithvickie.com email at: vickie@wellmanworks.com

Recent Comments